Those that are in the Memphis, TN area are always going to have different insurance needs. A form of coverage that can prove to be a very helpful form of protection is life insurance. This type of coverage will offer financial protection for those that you care about. Choosing the right type of coverage is important and term and whole life continue to be popular options. You should consider the features of each when building your next plan.

Term Life Coverage

One type of life insurance to consider getting is term life protection. This type of coverage is helpful as it will give you insurance protection for a specific period of time and you are able to build a plan that meets your needs in terms of coverage length and dollar amount of protection. Another advantage of this coverage is that it can have more affordable premiums than other types of insurance.

Whole Life Coverage

You can also consider getting whole life insurance coverage. With a whole life plan, you can get coverage that will last for the rest of your life. While the premium payments can be higher, there are also investment benefits that come with this coverage. With each payment you make, some money will build up in an account and will grow with interest. Eventually, you can take money out of this account.

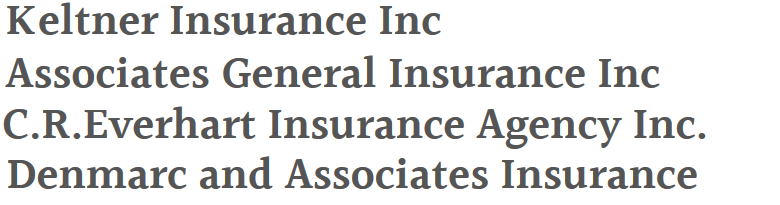

Picking a life insurance plan in the Memphis, TN area is a big decision. As you are assessing your insurance needs and options in this part of the state, you should call the team with Keltner Insurance. The professionals with Keltner Insurance can offer you great coverage and support to ensure you choose the right life insurance plan that will appropriately meet all of your needs.

Email An Agent

Email An Agent

GO

GO

More

More